Dual citizenship is a complex area – so seek professional advice before you make any decisions. However, to get you started, here are beginner guides to the laws concerning dual citizenship in the Philippines.

If you’re living some or all of the time in the Philippines, then seeking citizenship in the Philippines could make a lot of sense. Under local law, you’d have the same rights as any other natural-born Filipino, so for example, you’re free to travel in and out of the country without having to worry about visas. You’re also able to buy land, which is restricted to foreigners. But what if you don’t want to give up your original nationality to become Filipino?

Here’s where it gets tricky. The law of the Philippines doesn’t recognize dual citizenship for non-natives. This means that in most cases if you want to become a Filipino national, you’re forced to give up your original citizenship.¹ It’s different if you’re born in the Philippines, and then take up second citizenship elsewhere. In that case, you might be allowed to hold dual citizenship under Philippine law.

Dual citizenship is the status whereby a person is concurrently regarded as a citizen of two countries. Former natural-born Filipinos who have acquired citizenship of another country (for example, Australia) can reacquire their Philippine citizenship through the provision of the Philippine law Republic Act 9225 (Citizenship Re-acquisition and Retention Act of 2003). Persons who were naturalized Filipinos and had acquired citizenship of another country are not eligible for Philippine dual citizenship.

NOTE: This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication.

Dual citizenship in the Philippines depends on whether you’re a natural-born Filipino or not. Foreigners who want to become Filipino must renounce their original citizenship before they’re considered to be Filipino. That means that a foreigner can’t have dual citizenship in the Philippines.

However, if you were born in the Philippines or most cases if your parents are natural-born Filipinos, but you were born elsewhere, you get the right to citizenship of the Philippines automatically.¹ This can apply even if you’ve already naturalized as a citizen elsewhere and renounced your citizenship. Under a law known as R.A.9225, natural-born Filipinos who lost their citizenship when they naturalized as citizens in other countries, can apply to have their Filipino nationality reinstated.¹ In effect, this means that you can hold dual citizenship – but only if you’re considered to be Filipino by birth

WHO CAN QUALIFY UNDER RA 9225?

Those who are citizens of the Philippines from birth without having to perform any act to acquire or perfect their Philippine citizenship. These are the persons:

There are several steps to becoming a Filipino citizen. The exact process you follow will depend on whether you’re a foreigner acquiring citizenship through naturalization, or a natural-born Filipino reclaiming your citizenship after revoking it.

The steps you’re likely to have to take include the following:

1 . Photocopy of the following documents (original copies to be presented during on-site claiming and signing of dual citizenship documents):

2 . Photocopy of the applicant’s US passport data page (the original passport to be presented during on-site claiming and signing of documents)

3 . For those born before January 17, 1973, of Filipino mothers, and then elects Philippine citizenship upon reaching the age of majority.

Certified True Copy/Certification issued by a Philippine local civil registrar (LCR) that the statement of electing Philippine citizenship and oath of allegiance to the Philippines is registered with their office.

4 . For married female applicants, a copy of her marriage certificate.

5 . Completed Dual Citizenship Application Form

6 . Three (3) 2×2 Colored ID Photos with White Background without eyeglasses or coloured contact lens took within six (6) months from application.

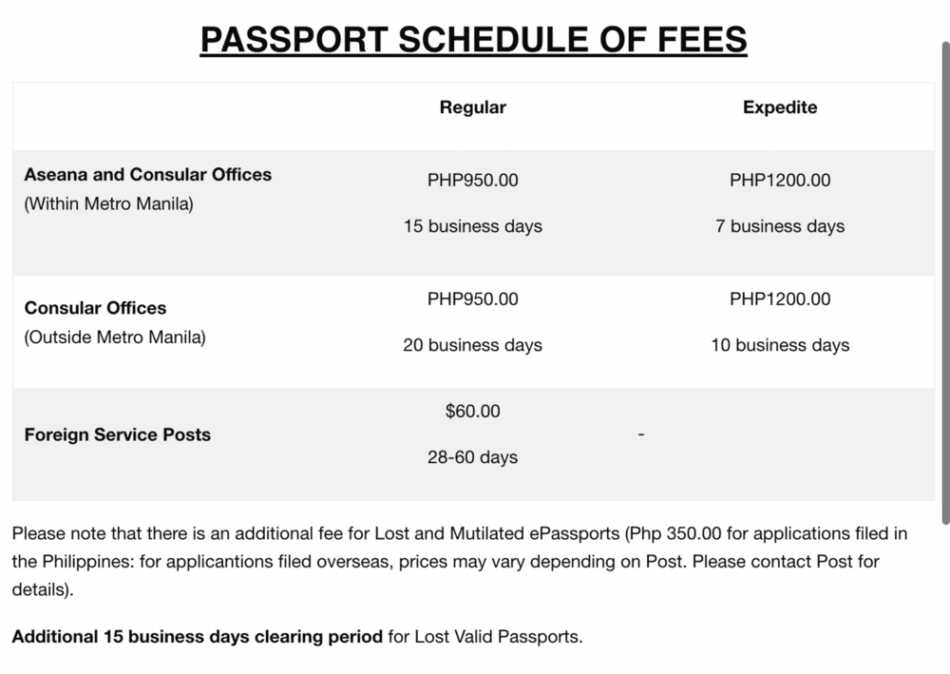

7 . Money order made payable to “The Philippine Consulate of the country you’re in” for the exact amount of fees to be charged for the service (see below for the list of fees). Personal checks and credit cards are not accepted.

The Consular Officer reserves the right to request additional documents from the applicant

The Consular Officer reserves the right to request additional documents from the applicant

• For those applying with derivative dual citizenship:For each of the applicant’s child below 18 years old, the applicant shall present the original document and photocopy of the following documents:

a) Child’s Birth certificate;

b) Child’s Foreign passport and

c) Child’s three (3) 2X2 COLORED ID Photos with WHITE Background without eyeglasses or colored contact lens took within 6 months from application

Note: Only children below 18 years old of age of former natural-born Filipinos may qualify for derivative dual citizenship.

Derivative dual citizenship must be distinguished from a dual citizen by birth. A dual citizen by birth is a natural-born Filipino born in the US/foreign country that allows dual citizenship; thus all that person/parent of the person needs to do is Report the Birth.

Prospective applicants for Dual citizenship in the Philippines under R.A. 9225 are advised to visit and read the contents on dual nationality of the country they’re in or to seek legal advice from an immigration lawyer.

If you become a citizen of the Philippines, can they legally force you to give up your other passport/nationality? Well, yes. Theoretically, you must renounce your other nationality when you become a Filipino if you’re taking on Philippine citizenship through naturalization. You have to commit to being loyal to the Philippines, and this is seen as something you simply can’t achieve if you’re also equally loyal to your place of birth.

Online commentators do discuss how you can take up citizenship of the Philippines without ever carrying out the full legal duties required by your home country to renounce your citizenship. That’s because some countries consider that people who acquired citizenship by birth can never lose it. Other countries make it quite a complex and lengthy process to renounce your citizenship.

That means that acting as a de facto dual citizen and holding two passports, for example, could be possible – but might very well be illegal. It could land you in trouble with both your home country and the Philippine authorities. Take legal advice before you make any decisions in this regard.

In most cases you have to have lived in the Philippines for 10 years before your application to become a citizen can be considered. However, this might be shortened if you’re married to a Filipino for example, or if you have a business in the country.

Once you have decided to apply for citizenship you have to declare your intention to do so up to a year before actually submitting your application. You should be told at this stage if there’s a problem with your application or any reason why you’re not eligible. It’ll then take a couple of months after this waiting period, to review and assess your application paperwork.

Residency in the Philippines is not required of those who wish to re-acquire or have re-acquired Filipino citizenship. Those who intend to vote in local elections, however, must establish residence in the locality where they wish to vote.

Documents

Fees (per applicant)

Dual Citizenship Documents

Affidavit of Explanation for not submitting Naturalization Certificate

Derivative Dual Citizenship Documents

Submission of requirements

If all of the documents are in order, applicants shall be notified by e-mail of the approval of the application and the schedule of the virtual oath-taking.

On-site signing and claiming of dual citizenship documents will be scheduled accordingly. The originals of all supporting documents should be presented on-site as a precondition to the claiming and signing of dual citizenship documents.

Things to Remember:

Filipinos who have re-acquired their PH citizenship under RA 9225 may once again enjoy full civil and political rights and be subject to all attendant liabilities and responsibilities under existing laws of the Philippines subject to conditions. These rights include:

1. To vote in the PH national elections

2. To run for or be appointed to public office

3. To practice his/her profession

Please note that the right to vote or be elected or appointed to any public office in the Philippines cannot be exercised by, or extended to, those who:

Do the same limitations on former Filipinos concerning land ownership still apply to those who have re-acquired their Filipino citizenship?

Having re-acquired Filipino citizenship under this Act, one is deemed to have re-acquired the right to own land as a Filipino citizen without prejudice to citizenship in a foreign country. The limitations imposed on former Filipinos no longer apply to them.

Dual citizenship in the Philippines – You can stay in the Philippines indefinitely provided that upon your arrival in the Philippines you present before the Philippine Immigration Officer your valid US/Foreign passport and your Dual Citizenship Documents.

EXCEPTION: when you travel with your Foreign Husband/Wife/Child.

There aren’t any schemes that are a direct replacement for citizenship. However, there are some good, and fairly flexible long-term visa options available which could be a good choice – for example, if you want to retire in the Philippines. (which I will discuss in the next article)

If you live and work abroad, or travel regularly between different countries, life can get pretty complicated. And questions of citizenship aren’t the only practical headache. Another big issue for many people is the cost of everyday banking. You can lose out, especially if you have to move your money between bank accounts held in different countries and currencies.

If dual citizenship is on your radar then you’re probably someone who travels frequently or lives and works abroad. Does this sound like you? Then you’ll know how important it is to find practical solutions to make your money work for you. If you spend your time moving between different countries, you could end up paying over the odds unnecessarily for day-to-day banking.

If you live outside the Philippines for over 180 days in a taxable year, only income generated within the Philippines is taxed by the Philippine government.

Note that the Philippines and the United States of America signed a treaty on taxation in order to avoid double taxation for Filipinos who derive income from the United States and for Americans who derive income from the Philippines. Under this treaty, taxes paid in the United States may be credited to the Philippines and vice versa.

The Board of Investments of the Department of Trade and Industry (BOI-DTI) may assist overseas Filipinos in promoting their commercial interests in the Philippines. They may be contacted through:

Board of Investments, Department of Trade and Industry

Address: 385 Sen. Gil Puyat Ave., Makati City

SOURCE: Department of Foreign Affairs, Philippines